Over the past few years, the Eurozone seems to have been lurching from one crisis to another, with no apparent prospect of a resolution. Just as the authorities manage to snuff out a crisis in one market, a new one would spring up elsewhere. The most recent hotspot has been Portugal, where President Cavaco Silva has been forced to step in to save the country’s bailout programme. And, looking ahead, it seems trouble is brewing once again in Italy, whose sovereign credit rating has been cut by a major rating agency. It’s almost as if Europe is caught in a nightmare version of a two-step dance: moving forward a bit, then falling back again.

While the political situation across Europe fluctuates, its economy is beginning to turn a corner. A continued recovery depends in part on the health of the global economy, particularly China and the US, which are the EU’s two biggest trading partners. Reports about China’s declining growth rates and a domestic lending crisis should not be overplayed, as the country will continue to be a major driver of the global economy. In the US, the economy has posted encouraging signs of recovery, in part because politicians have avoided the temptation (or lack the political will) to impose heavy austerity measures.

With economic improvement set against a benign macro outlook, the investment case for Europe is better than many investors think, according to Uwe Zoellner, Head of European Equity, and Mike Clements, Portfolio Manager, Franklin Equity Group©. Zoellner says that although the economic glory days may be a thing of the past for the developed world, he nevertheless sees signs of sustainable progress.

“In Europe, things have improved considerably since last year. I think there is a positive backdrop for equities. But I don’t think we will return to the golden era of the late ’90s to 2008 because we will not see that level of debt-driven growth again. Growth rates globally will likely be more pedestrian but, on the other hand, I believe they will be more sustainable.”?

Uwe Zoellner

A Long Horizon for European Equity

Zoellner is bullish on European equities, although he expects some continued volatility.

I would stress that the long-term outlook for Europe remains positive. However, I think we will continue to see volatility going forward and the last few months have demonstrated that. Volatility is something we have to get used to, but, in our view, it can also bring opportunities. We have a bottom-up approach to stock selection and our process is to evaluate companies on an individual basis. We tend to be contrarian in our style, meaning our philosophy and process often leads us to segments of the market that are out of favour with other investors. I think this year our approach will be more important than ever because you can’t buy indiscriminately in this market. In particular, you have to be cautious of some defensive companies or companies with global exposure in consumer sectors that have been most investors’ favourites but which are quite expensive right now.

Many investors have shortened their investment horizons and become a bit more cautious, due to market uncertainty and news about downgrades. But I think now people are looking at the long-term outlook for European equities and they are thinking about the potential upside. I believe the long-term story in Europe is about further structural reforms. We expect to see a normalization of the situation in large parts of Europe, which should be a future driver of performance.

Eurozone Recovery

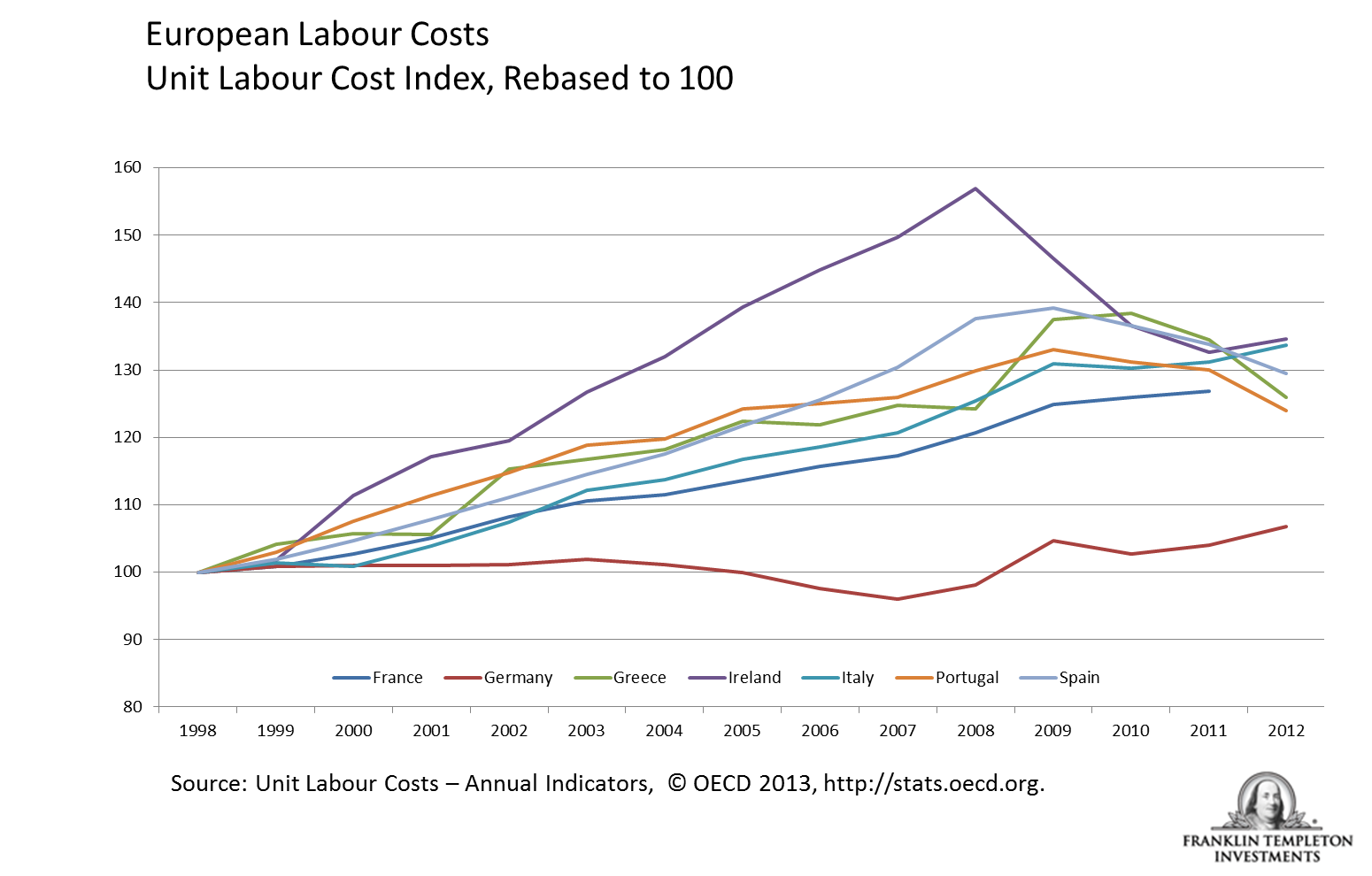

Zoellner believes a strong case can be made for recovery in the Eurozone by looking at falling unit labour costs.

Quite a few countries in Europe are cutting their labour costs. Germany ran into trouble long before the global crisis due to the costs of reunification. As a result, it had to make adjustments to its economy, which improved its unit labour costs and its competitive advantage within the Eurozone. By contrast, other countries in the Eurozone became more expensive and less efficient, and now the pressure is on them to reduce costs.

Ireland was the first Eurozone country to make real progress on structural economic reform. But Ireland is not alone in embracing the economics of austerity; we are seeing similar reforms implemented in other countries across the Eurozone. In Spain, we have seen a drop of 10% in unit labour cost since the peak, which shows that progress is being made through these reforms. We have clear progress in many countries, where a decline in unit labour cost implies improved competitiveness.

Encouragingly, market data indicate companies in southern Europe are becoming more competitive. Spanish companies, faced with anaemic growth in their domestic market, have had to look beyond their borders for compelling growth opportunities. This is a common theme across the region. It’s a slow process and may take three to five years, but we believe progress will come. Also, if we are to see real momentum, we think the global economy must be supportive of this incremental growth.

We still see some laggards, such as Italy and France where we still have political resistance to reform In general, however, we see good reason to be optimistic, since reform efforts should boost profitability and create significant potential for stock markets in Europe.

Small-Cap Attraction

In the realm of equities, many investors seeking what they believe to be safe havens will gravitate toward large-cap stocks over the small-caps, thinking they are more likely to outperform, or at least survive. Taking a contrarian view, Clements makes the investment case for taking a highly selective approach focused on high quality stocks, many of which can be found in the small- and mid-cap space.

“We don’t spend a lot of time looking at whether small-caps are performing versus large-caps. However, there are many small-cap companies in Europe which have very strong business models but which are not on the radar of other investors. This can lead to more attractive valuations. For example, we recently found a UK company in the shipping industry, which is a market leader by far, has a rock solid balance sheet and earns high returns on equity but whose valuation was attractive because that industry is currently out of favour.”

Michael Clements

For European investors looking to invest closer to home, the picture seems to be that, while Europe’s economic two-step hasn’t ended yet, the dance may be more worth doing than many investors may fear.